The Dynamics of Currency Trading A Comprehensive Guide to Forex

The Dynamics of Currency Trading: A Comprehensive Guide to Forex

Currency trading, commonly referred to as Forex trading, is one of the most dynamic and fast-paced financial markets in the world. With a daily trading volume exceeding $6 trillion, Forex has become an essential platform for investors, traders, and institutions looking to capitalize on currency fluctuations. Understanding the mechanics of this market, along with its strategies, risks, and the tools available to traders, is crucial for anyone looking to participate effectively. For those seeking reliable platforms, currency trading forex Forex Brokers in Kuwait can provide localized support and services tailored to regional needs.

What is Forex Trading?

Forex trading involves the exchange of one currency for another in the global marketplace. Unlike stock markets, which operate during specific hours, the Forex market is open 24 hours a day, five days a week, making it accessible for traders around the clock. This continuous operation allows for various trading strategies, from day trading to long-term investments.

How Does Currency Trading Work?

Currency trading occurs in pairs, such as EUR/USD or USD/JPY. Each pair consists of a base currency and a quote currency. The price of a currency pair reflects how much of the quote currency is needed to purchase one unit of the base currency. For example, if the EUR/USD pair is quoted at 1.20, it means that 1 Euro can be exchanged for 1.20 US Dollars.

Major Currency Pairs

The Forex market features several major currency pairs that dominate trading volumes:

- EUR/USD: Euro / US Dollar

- USD/JPY: US Dollar / Japanese Yen

- GBP/USD: British Pound / US Dollar

- USD/CHF: US Dollar / Swiss Franc

These major pairs are usually favored by traders due to their liquidity and tighter spreads, which can lead to more profitable trades.

Trading Strategies

The Forex market allows traders to adopt various strategies depending on market conditions and personal preferences:

- Scalping: A short-term strategy aiming for small price changes and quick profits.

- Day Trading: Involves buying and selling currencies within the same trading day, closing all positions before the market closes.

- Position Trading: A long-term strategy that involves holding onto trades for weeks, months, or even years based on fundamental analysis.

Choosing the right trading strategy is vital for success and should align with the trader’s risk tolerance and market outlook.

Risk Management in Forex Trading

Risk management is crucial in Forex trading due to the market’s inherent volatility. Traders must be aware of their risk exposure and implement strategies to protect their capital. Here are some common risk management techniques:

- Setting Stop-Loss Orders: This involves placing an order to sell a currency pair once it reaches a specified price, limiting potential losses.

- Diversifying Investments: Avoiding placing all capital into a single currency pair can help manage risk.

- Using Leverage Responsibly: While leverage can amplify returns, it can also increase losses. Traders should use it judiciously.

Choosing the Right Forex Broker

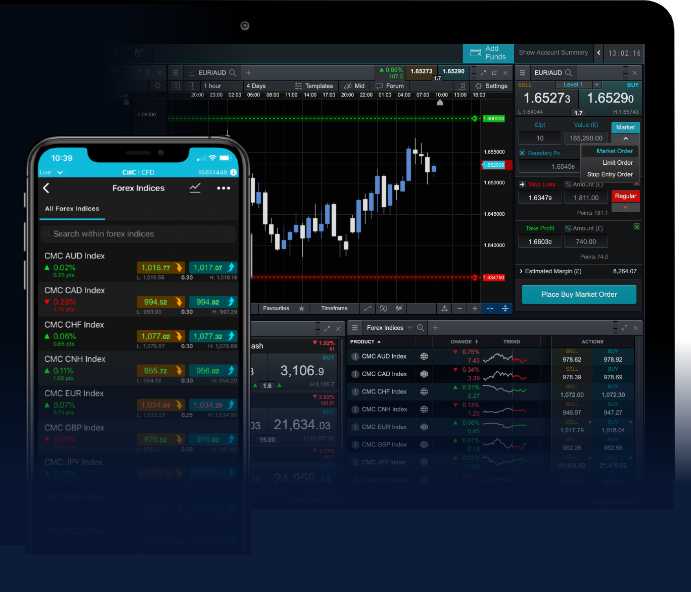

Your choice of broker can significantly impact your trading experience. A good Forex broker will provide a user-friendly trading platform, competitive spreads, and reliable customer support. Here are some factors to consider when selecting a Forex broker:

- Regulation: Ensure the broker is regulated by a reputable financial authority.

- Trading Costs: Look for brokers with low spreads and commissions, as these can affect your profitability.

- Trading Tools and Resources: A good broker should offer a variety of tools, including charting software, news feeds, and educational resources.

The Future of Forex Trading

The future of Forex trading looks promising, with advancements in technology continuing to shape the market landscape. The rise of cryptocurrencies and blockchain technology introduces new opportunities and challenges for traders. Additionally, artificial intelligence and machine learning are set to provide traders with enhanced data analysis capabilities, allowing for more informed decision-making.

Conclusion

Currency trading in the Forex market presents numerous opportunities for profit but also carries significant risks. By understanding the mechanics of trading, developing effective strategies, and employing robust risk management techniques, traders can increase their chances of success. As you embark on your Forex trading journey, remember the importance of choosing a reputable broker and staying informed about market trends. With the right tools and knowledge, you can navigate the complexities of the Forex market and work towards achieving your financial goals.